Each week, our Editor runs scans within the Trading Edge Platform and identifies charts of interest for members. From the scan results he selects trading opportunities for members and identifies potential prices for Entries, Stops and Profit targets using TED’s unique Bull and Bear Alert triggers combined with support and resistance levels.

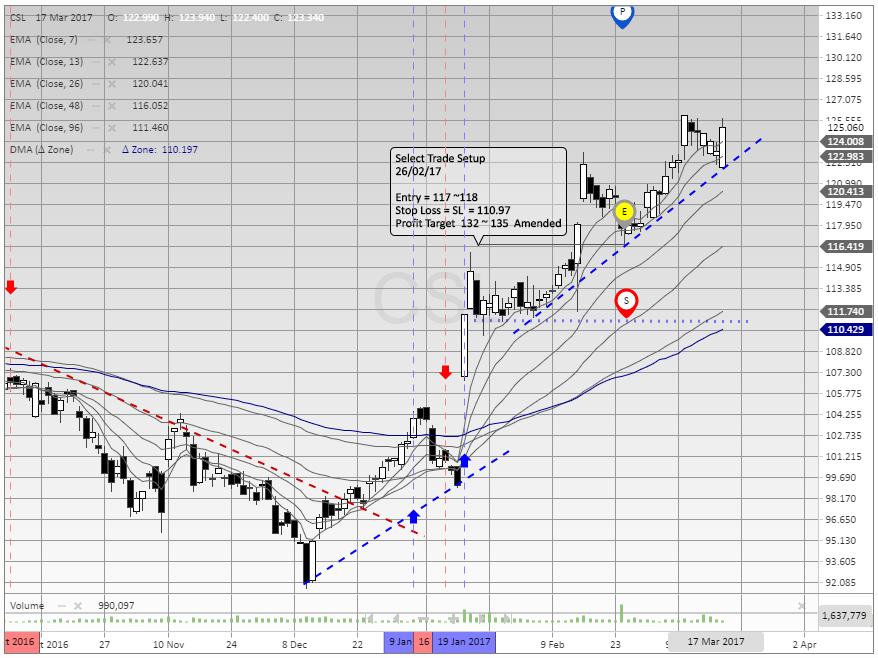

CSL Limited (CSL) was identified as a trading opportunity on the 26th February after a recent Flex term alert. An entry zone of between $117 and $118 was flagged after a recent break up and retest of the breakout area. A logical stop below a recent level of support at $111.00 (stop at $110.97) was highlighted. A potential profit target range between $132 and $135 was also flagged. An entry was taken at $117.40 on the 27th February.

In mid April, the stop on the trade was moved to above break even to just under a recent low of $121.48. Profits were taken on the 28th April at $132.55 for a 12.62% return. The stock went ex-dividend on the 15th March and a small dividend was received making the overall return on the trade 13.33%. The stock was held for a total of 61 days.

There are two ways to handle a trade like this one in CSL which is continuing to make new highs:

- Take profits at the set target – in our case the profit target was arbitrarily set at 10% above a previous high

- Set a trailing stop – for example, you could use a % trailing stop which would trigger an exit if price fell x% from the highest point or you could place a stop below recent low consolidation areas.

For the Editors Select trades we generally close trades by taking profits if prices reach our profit targets. This also fits in with our overall seasonal strategy of reducing exposure and taking profits where possible during the month of May.

If you would like to learn more about the Trading Edge Dynamics platform and take advantage of our Editors Select Trade Setups, sign up for a free 14 day free trial.