To be successful as a trader you need to learn how to manage your risk. One way of doing this is to use a position sizing technique where you know the amount of capital you are putting at risk before you enter any trade.

At Trading Edge Dynamics we encourage appropriate position sizing. Our Editors Select Setups come with suggested entry, stop and profit target price points to help you manage your risk.

How does knowing these price points help?

Let’s take a look at the position sizing technique and explain the process.

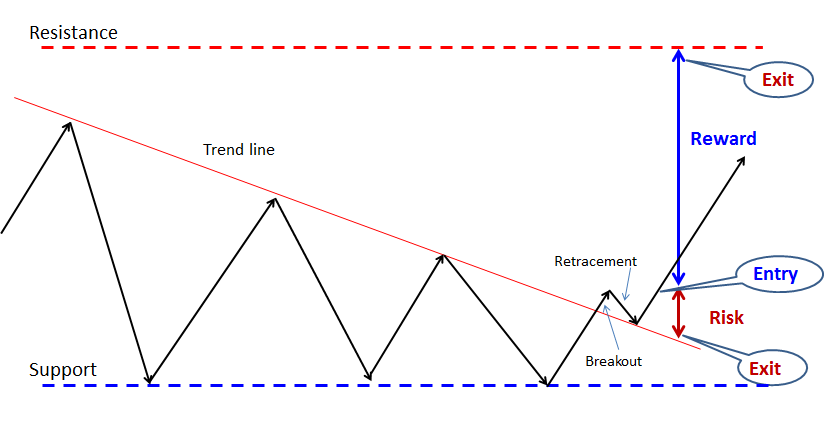

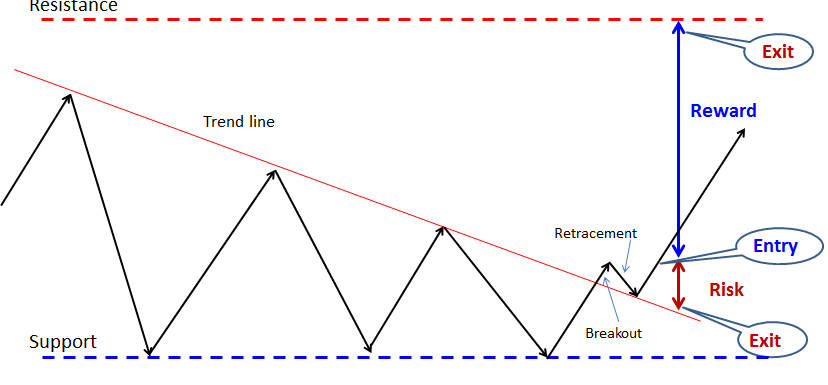

The diagram below shows a theoretical trade – a horizontal resistance line, a rising support line and a suggested entry when price breaks above the resistance line. The stop on the diagram is quite close to the entry point and the next overhead resistance give us a potential profit target. We can now use 2 of these price points (the entry and the stop) to decide a position size appropriate for our portfolio.

The term for this position sizing technique is fixed fractional position sizing but don’t let the term put you off – all it means is that only a fixed percentage of your portfolio value is allowed to be put at risk for each trade and the size of the parcel allowed will depend on where the logical stop is for a trade.

Position Sizing in Action

Let’s take a look at a recent Editors Select Setup trade and see how the method might have been used to determine how many shares (our position size) we would buy.

On the 5th March this stock was recommended as a trade with a suggested entry zone of between $8.50 and $8.65. The recommended stop was $8.18 with a profit target of $9.75.

Let’s say our portfolio value is $100,000 and we have decided that we will risk no more than 1% or $1000 on any one trade. For this trade our entry could be $8.65 (the highest possible price in our entry zone) and our stop is $8.18 – the difference between the two is $0.47 per share. To arrive at an appropriate position size we divide our $1,000 allowable at risk capital by $0.47 and we arrive at 2127 shares. So we know we can purchase 2127 shares at no more than $8.65 and (barring slippage) be comfortable that we are not putting more than 1% of our portfolio at risk. For this trade our position size would be $18,395.55 (note that none of our calculations include brokerage).

All calculations are relatively straightforward and just use basic maths principles so any trader can use them to help manage their risk.

Whatever position sizing strategy you choose to use, make sure you write down your rules. They will be so much easier to follow if they are written down. Also make the position sizing process as automatic as possible – a simple spreadsheet can make the process easier.

If you would like to learn more about the Trading Edge Dynamics platform and take advantage of our Editors Select Trade Setups and downloadable templates to help your trading, sign up for a free 14 day free trial.

Perhaps you could write subsequent articles relating to this article.

I desire to read more about it!